main content Investments

The Business Office is responsible for endowment, trusts and other investments of the college.

Endowment

Lewis & Clark College, formerly known as Albany Collegiate Institute, was founded in 1867 when Albany residents raised $8,000 in cash and promissory notes to erect a building for the school on land donated by Thomas and Walter Monteith. Over the years, thousands of donors have established endowed funds for scholarships, professorships, and many other purposes. Today, Lewis & Clark’s endowment comprises nearly 70 funds with a market value of $306.4 million as of May 31, 2023. The endowment at Lewis & Clark plays a vital role in supporting the college’s educational mission.

The long-term financial objective for the endowment is to preserve and enhance the value of the principal to provide a stable stream of earnings in perpetuity supporting the College’s spending needs. The College’s Investment Committee provides oversight for the endowment investment management. Investment decisions are made with the intent of obtaining returns sufficient to grow the inflation-adjusted value of the endowment in perpetuity. The approved investment and spending policies listed below serve as guidelines for the endowment investment program.

-

Investment Policy - sets the asset allocation, and is reviewed regularly and updated as needed.

-

Spending Policy - spends 5 percent of the sixteen-quarter moving average market value of the Endowment Fund annually for the designated purposes of the funds.

May 31, 2024 Market Value & Asset Allocations

| Asset Allocation |

Actual Allocation |

Market Value ($M) |

| U.S. Equity | 15.2% | $48.5 |

| Global Equity | 8.7% | $27.7 |

| International Developed Equity | 9.2% | $29.4 |

| Emerging Markets Equity | 4.7% | $15.0 |

| Venture/Private Equity | 26.4% | $84.1 |

| Marketable Diversifiers | 11.4% | $36.5 |

| Private Diversifiers | 4.5% | $14.3 |

| Private Real Assets | 5.2% | $16.6 |

| Fixed Income | 12.6% | $40.0 |

| Cash & Other | 2.1% | $6.7 |

| Total Endowment Value | 100% | $318.8 |

LC Endowment Newsroom

- Endowment Impact Benchmark: Lewis & Clark Earns the Highest Mark

- How Endowments Can Evaluate Their Sustainability Levels

- Decarbonization Is the New Divestment as Company Disclosures Increase

- Net-Zero Endowments Best Achieve Fossil Fuel Divestment

- Cambridge Associates - NZICI Progress Report as of September 2023

- Oregon Venture Fund - Lewis and Clark Invests Locally to Benefit Students

Our Sustainable Investment Journey

Environmental, Social, and Governance (ESG) Investment Principles

Lewis & Clark is committed to learning, innovation, and principled action on matters related to sustainability. Ensuring our investments align with our principles is crucial to our commitments. In line with this dedication, the College integrates environmental, social, and governance (ESG) factors in our investment decisions. Since 2014, when ESG practices were first included in the policy, the college has recognized the proliferation of research and products integrating these factors for better risk-adjusted returns. Acknowledging the material impact of ESG factors on the value of companies and securities, the Board of Trustees Investment Committee further expanded its support for managers utilizing ESG in their investment analyses. To formalize this commitment, the College adopted the integration of an Enhanced ESG Investment Policy Statement, in April 2017, into the existing policy.

Divestment from Fossil Fuels: A Bold Beginning

In February 2018, our Trustees made a unanimous decision to divest from fossil fuel holdings, marking a significant commitment towards sustainability in our investment practices. Over the initial year, the College successfully reduced its exposure to publicly traded fossil fuel companies by more than half, showcasing our commitment to environmental leadership. The divestment initiative set forth the following goals:

- Lewis & Clark’s endowment shall not directly own any securities publicly issued by companies in the fossil fuel industry, specifically the largest owners of coal, oil, and natural gas reserves (“fossil fuel companies”).

- Starting immediately, Lewis & Clark will make no investments in any new fund that has exposure to fossil fuel companies. Over the next five years (before Dec. 31, 2022) Lewis & Clark will eliminate exposure to fossil fuel companies held indirectly through public commingled strategies. In addition, the college will exit all private limited partnership investments holding fossil fuel companies as they mature, which will take more than five years.

- Consistent with the college’s existing ESG policy, Lewis & Clark will actively engage with existing investment managers to encourage them to adopt fossil fuel-free investment options.

- Lewis & Clark will provide an annual update to the broader campus community on holdings of fossil fuel securities in the endowment portfolio.

This original divestment policy acknowledged that full divestment by 12/31/22 would not be possible. Specifically, the policy included the following language, “In addition, the college will exit all private limited partnership investments holding fossil fuel companies as they mature, which will take more than five years.” The Divestment Sub-Committee and the Board approved that language because they were aware that the College was in a number of private partnerships that take a long time to unwind. The bulk of this exposure is with private investment funds the College committed to from 2008-2014, and are very much in wind-down mode. The exact timing is uncertain and beyond the College’s control, but the endowment would expect to experience a gradual reduction over the next five years and would expect this exposure to be reduced by another 50-75% over that timeframe. We have instructed our investment advisor to periodically assess opportunities for early exit from these investments. While the endowment has lingering exposure, it is helpful to know that the plan remains to exit these investments as soon as practicable. More information on the process of divestment can be found here Trustees Exploring Fossil Fuel Divestment.

Evolving with Best Practices: Our Path to Net Zero

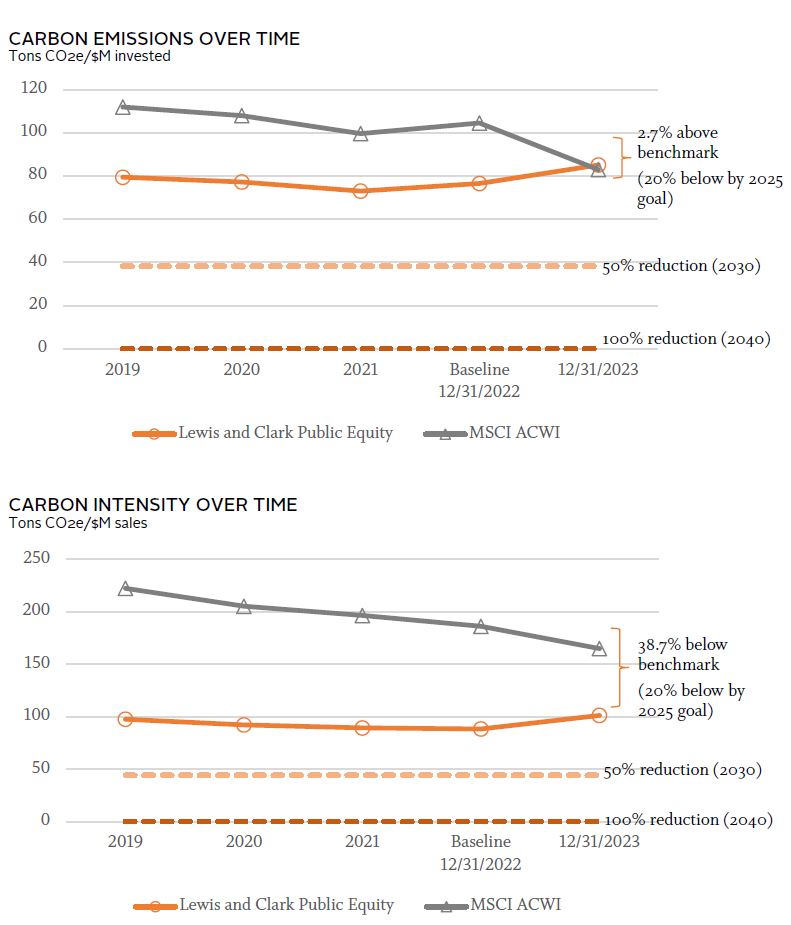

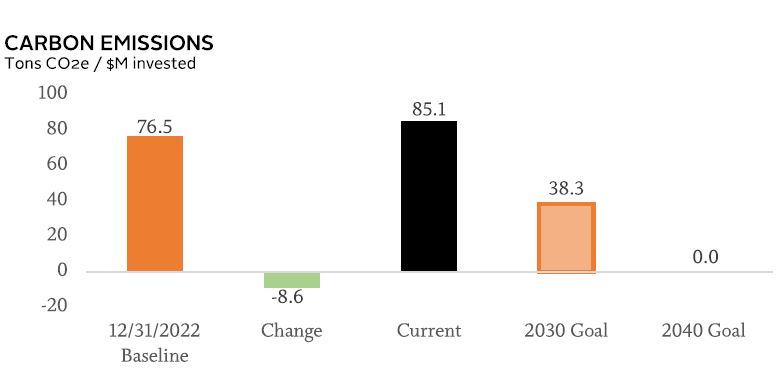

The 2018 policy was a tremendous achievement and the policy language was a leading example of integrating ESG considerations into investment management. However, ESG and climate change considerations in particular have been rapidly evolving, and there was an opportunity to refresh the language while maintaining the College’s goal of best-in-class endowment management. The language adopted in October 2022 includes targets to “Net Zero,” which is an increasingly common approach taken by global investors, companies, and governments for accelerating transition toward sustainability and mitigating climate change. Net Zero refers to the objective of having a society that no longer contributes additional greenhouse gas emissions to the atmosphere. Our new policy language targets the College’s portfolio to reduce GHG emissions in the portfolio by 50% by 2030, and 100% by 2040. The 2040 date is more aggressive than the emerging standard (2050), but is in line with the College’s role as a leader in sustainability. The Net Zero commitment targets real-world impact, beyond portfolio emissions, that includes engagement and divestment. The policy also recognizes that the available data and measurements are not perfect and will continue to improve and evolve in the coming years. The newly adopted policy additionally sets out a commitment to invest at least 5% of the portfolio in climate solutions, which would include strategies that have the reduction or removal of greenhouse gas emissions as a core part of their strategy (e.g., renewable energy infrastructure, cleantech VC).

Over the past years, the College committed over $9 million to various sustainability-focused funds, aiming to benefit from the transition to a low-carbon economy. This move represents our broader strategy to invest in renewable energy, cleantech, and other sustainable assets, reflecting our dedication to a sustainable future. While divestment conveyed a strong message, skeptics argued that it might not prompt substantial changes in company behavior, and its financial impact on large corporations could be restricted. In contrast, the shift towards Net Zero endowments signifies a more proactive stance in addressing climate change. Instead of merely avoiding certain investments, institutions are now committed to actively reducing their overall greenhouse gas emissions. This strategic shift involves setting specific emission reduction targets for investment portfolios and engaging with investment managers to develop strategies aligned with these targets. Net Zero strategies provide flexibility for institutions to engage with companies and industries, encouraging positive changes in practices and actively contributing to environmental solutions. The Net Zero approach demonstrates a commitment to responsible investment practices that align more closely with institutional values and contribute to the urgent global efforts to combat climate change. In essence, this evolution represents a more comprehensive and impactful approach to responsible investing, transcending symbolic gestures towards active contribution to a sustainable and environmentally responsible future

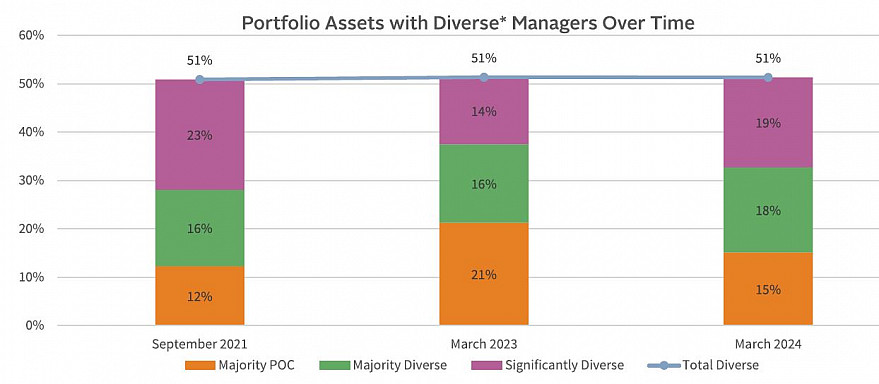

Beyond Net-Zero: Empowering Diversity, Equity and Inclusion in Investment Management

The College’s commitment to ESG investing goes beyond our Net Zero policy. In line with its institutional commitments, the College has further incorporated language in the Investment Policy Statement that encourages an increase in the number and assets invested with diverse managers, defined as firms substantially (33%+) owned by or firms/strategies substantially led by women and/or people of color. In partnership with its OCIO, Cambridge Associates, the College has committed to pursue the manager diversity objectives and sustainability objectives in parallel, recognizing that not all managers will match the diversity profile, nor will all managers match the climate change solutions potential of the College’s sustainability-oriented managers. Cambridge Associates has made a public commitment to double the percentage of client capital deployed to diverse-owned and -led managers within the next five years, and to engage all managers in its client portfolios to enhance inclusivity within their firm management and investment teams.

What’s Next?

- Our approach to evaluating managers has always been and will continue to be based on deep research and diligence, which helps us avoid “green-washing”. Prudent investment management remains our primary focus: as the College increasingly and prudently incorporated ESG considerations into the investment management process, results have outpaced benchmarks and the broad peer universe.

- We will continue to be driven by facts and data, including the upcoming carbon footprint analysis. Reducing emissions in the portfolio is a way to manage against the financial risk that climate change and the energy transition have created for all industries globally

- The College’s approach to ESG investing will continue to evolve to incorporate best practices and frameworks as they develop.

Net Zero Resources

- https://www.msci.com/our-solutions/climate-investing/climate-and-net-zero-solutions

- https://www.cambridgeassociates.com/insight/investing-for-a-net-zero-world-a-guide-for-investors/

- https://www.cambridgeassociates.com/insight/from-policy-to-implementation-a-net-zero-playbook-for-investors/

Reporting to our Community

We acknowledge the importance of transparency and accountability in our investment practices. Our website serves as a platform for sharing progress reports, reinforcing our commitment to open communication with our community.

Divestment Reporting- Fossil Fuel Exposure in the Endowment

Year |

Amount Invested with Fossil Fuel Exposure |

Portion of Endowment Portfolio |

12/31/2017 |

$11.7m |

4.9% |

12/31/2018 |

$8.4m |

3.8% |

12/31/2019 |

$7.9m |

3.1% |

12/31/2020 |

$6.2m |

2.2% |

12/31/2021 |

$7.3m* |

2.1% |

12/31/2022 |

$5.2m |

1.7% |

12/31/2023 |

$6.7m* |

2.1% |

Change since 2017 |

-43.0% |

-56.7% |

*The increase in fossil fuel exposure is related to favorable returns and the related increase in investment value. The College has made no new fossil fuel investments.

Net Zero Reporting- Portfolio Emissions Dashboard

Diversity Reporting- Endowment Assets Invested with Diverse Managers

Year |

Total Endowment Allocation to Majority POC and Diverse Managers |

Subset: Endowment Allocation to Majority Diverse Managers |

Subset: Endowment Allocation to Majority-POC Managers |

9/30/2021 |

51% |

39% |

12% |

3/31/2023 |

51% |

30% |

21% |

3/31/2024 |

51% |

37% |

15% |

Business Office is located in Frank Manor House on the Undergraduate Campus.

MSC: 31

email busoffc@lclark.edu

voice 503-768-7815

fax 503-768-7805

Chief Financial Officer and Vice President for Operations

Andrea Dooley

Business Office

Lewis & Clark

615 S. Palatine Hill Road

Portland OR 97219